Accor announced in October 2020 that they are in the process of launching co-branded credit cards for Europe with a French bank called BNP Paribas (read more here).

The launch was delayed, but more information about these cards was first released in June (read more here) and then clarified (read more here). These cards became available for application in France late last week.

You can access the cards here.

READ MORE: Accor ALL Rate & Bonus Points And Miles Promotions

Card Information In Consented Format:

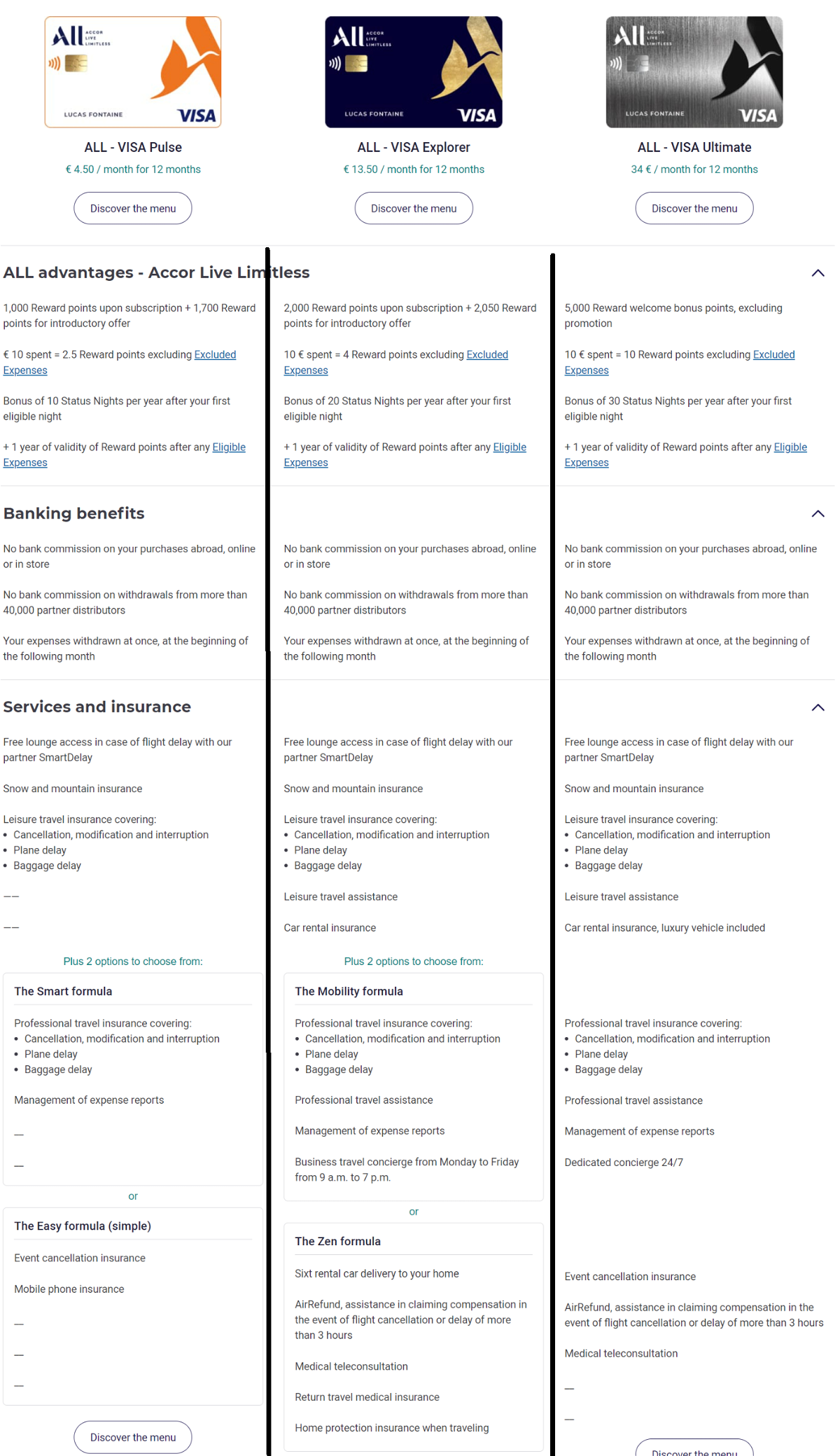

Here are the cards:

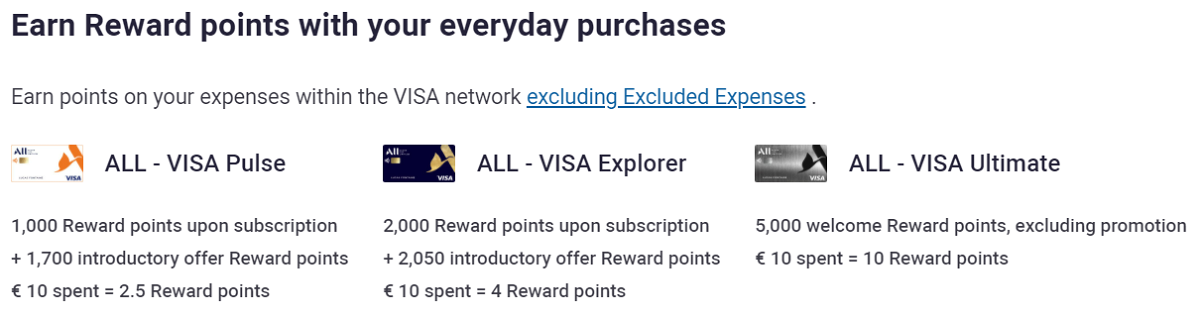

- ALL – VISA Pulse (aimed at Millennials) – a monthly fee of €4.5 (€53 per year)

- ALL – VISA Explorer (for clients who travel extensively for work or leisure) monthly fee of €13.5 (€162 per year)

- ALL – VISA Ultimate (for super-premium clients) monthly fee of €34 (€408 per year)

Cards come with yearly bonus nights:

- ALL – VISA Pulse – 10 NIGHTS

- ALL – VISA Explorer – 20 NIGHTS

- ALL – VISA Ultimate – 30 NIGHTS

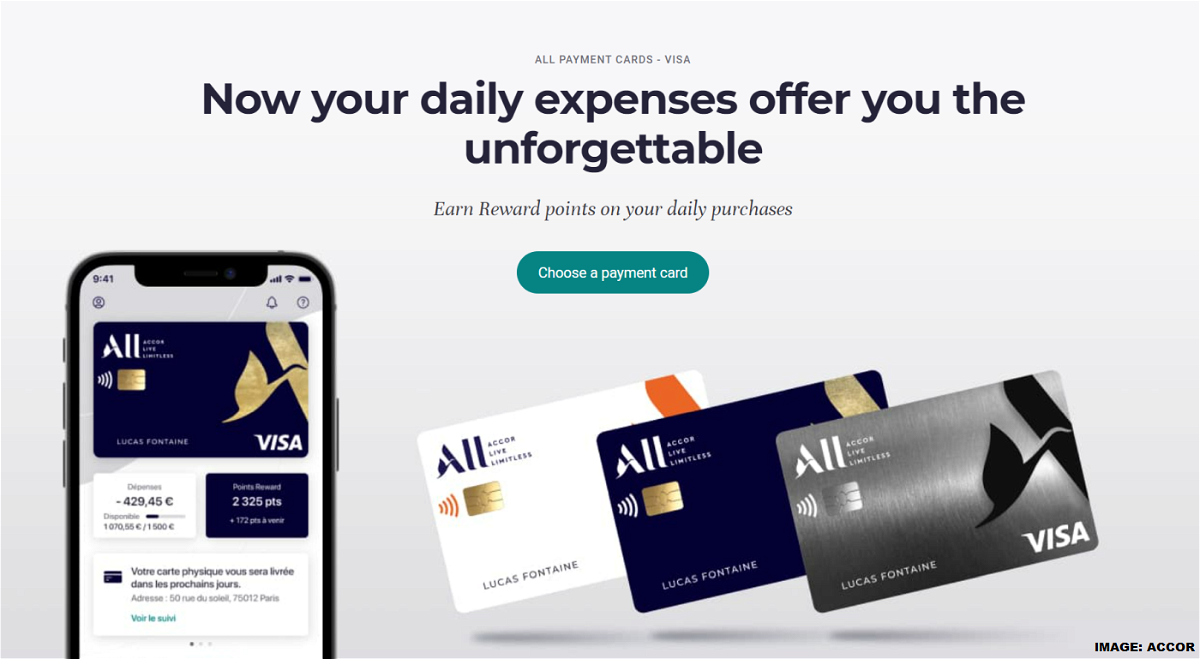

Sign Up Bonus

- ALL – VISA Pulse – 1,000 Rewards points + 1,700 limited-time bonus points (worth €54)

- ALL – VISA Explorer –2,000 Rewards points + 2,050 limited-time bonus (worth €81)

- ALL – VISA Ultimate – 5,000 Rewards points + promotion unclear (worth €100)

They mentioned the promotion o the Visa Ultimate card, but it is not disclosed anywhere. The signup bonuses for Visa Pulse and Visa Explorer cards are valid until July 29.

Rewards

- ALL – VISA Pulse – 0.25 points per €1 (0.5% return in the form of ALL points)

- ALL – VISA Explorer – 0.4 points per €1 (0.8% return in the form of ALL points)

- ALL – VISA Ultimate – 1 points per €1 (2% return in the form of ALL points)

Here are the cards available:

Visa Pulse

Visa Explorer

Visa Ultimate

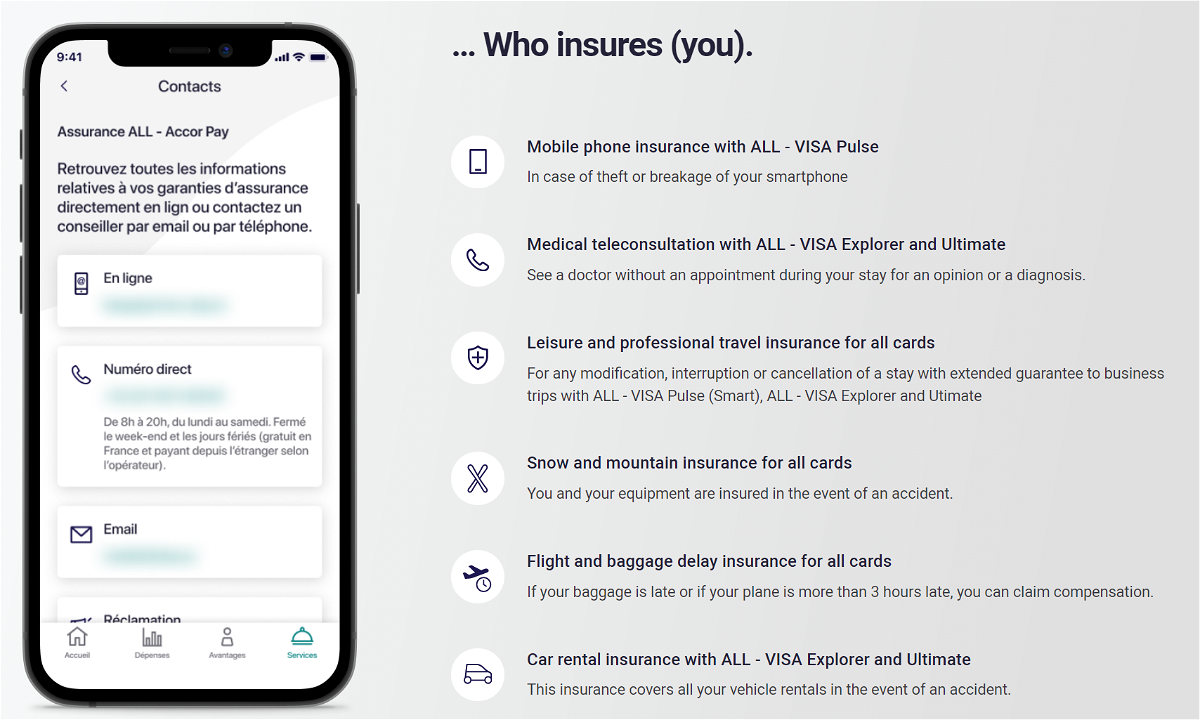

Accor Pay App

Insurance Benefits

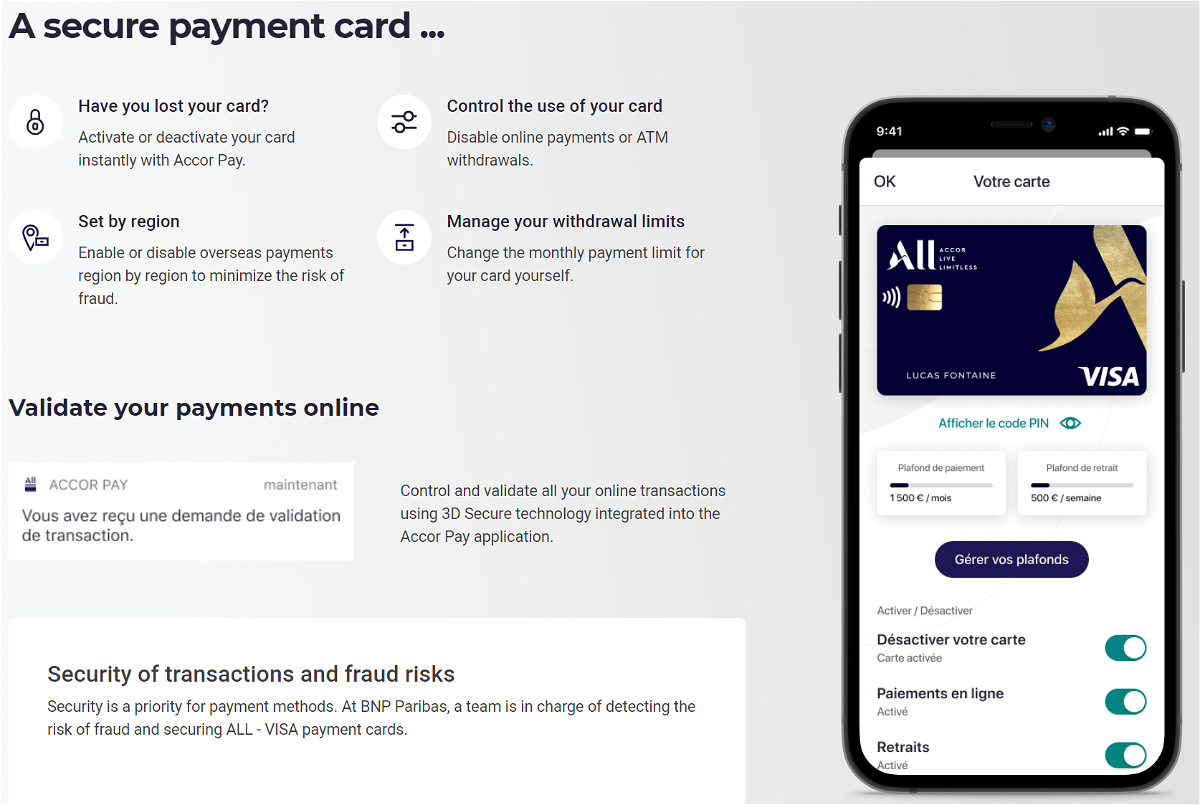

Secure Payment Cards

Conclusion

I like the fact that you can get 2% of the purchase made back in the form of ALL points, but you need to pay €408 per 12 months for this privilege, so better swipe the card a lot.

Also, there is not fee for swiping the cards outside of the Euro-area. Many European banks charge a 2% to 3% fee if you use the card in other currencies, so this is a good feature.

Essentially, members pay for 10/20/30 additional elite qualifying nights every year by paying the fee for these cards, whether you decide to swipe the cards or not. It is easier to get nights this way than doing mattress runs at hotels where you don’t need or actually want to stay.

I know that readers in the United States are rolling their eyes at the lack of benefits and weak benefits. However, you do need to know that there are very few lucrative cards for the European market where interchange fees are capped, and you usually pay the entire card balance every month (no interest income to the bank). These Accor ALL BNP cards withdraw the account balance from your associated bank account monthly.

I could theoretically open one of these accounts if I set up an account with HSBC in France, although they are in the process of exiting the market, and use a friend’s local address for shipping the card. Just too complicated.