Today, we have a Reader Question from an Amex Bonvoy Brilliant cardholder who is seeking the best value to redeem the annual free night certificate, which is capped at 85,000 points per night.

Readers are encouraged to send us questions, comments, or opinions by email, Facebook, Twitter, or Instagram. We’ll try to cover them here several times a week.

The Marriott Bonvoy Brilliant card by Amex USA comes with instant Platinum status, a Priority Pass, $25 F&B credit per month, and the 85,000 points capped stay certificate for any Marriott property.

Using this certificate to its maximum value has always been a little challenging to accomplish because, naturally, one wouldn’t want to waste such a high-value certificate on a mediocre property.

Our reader Michelle asks:

I’ve had the Brilliant card for two years now, and this is the first time I got the free night certificate (first year having received the signup bonus in the first year).

There are no properties that would cost 85,000 points in my immediate area and I can’t think of any place to travel far just to use it for one night.

What should we do with this?

For one, I don’t think this card is a very good fit for Michelle if she doesn’t travel enough to even find a suitable location or reason to spend a night at an 85k property.

This card costs $695 per year, and that’s simply too much money to just keep it casually without having a clear-cut use for the benefits. Downgrade the card to the Basic Bonvoy Amex at $95.

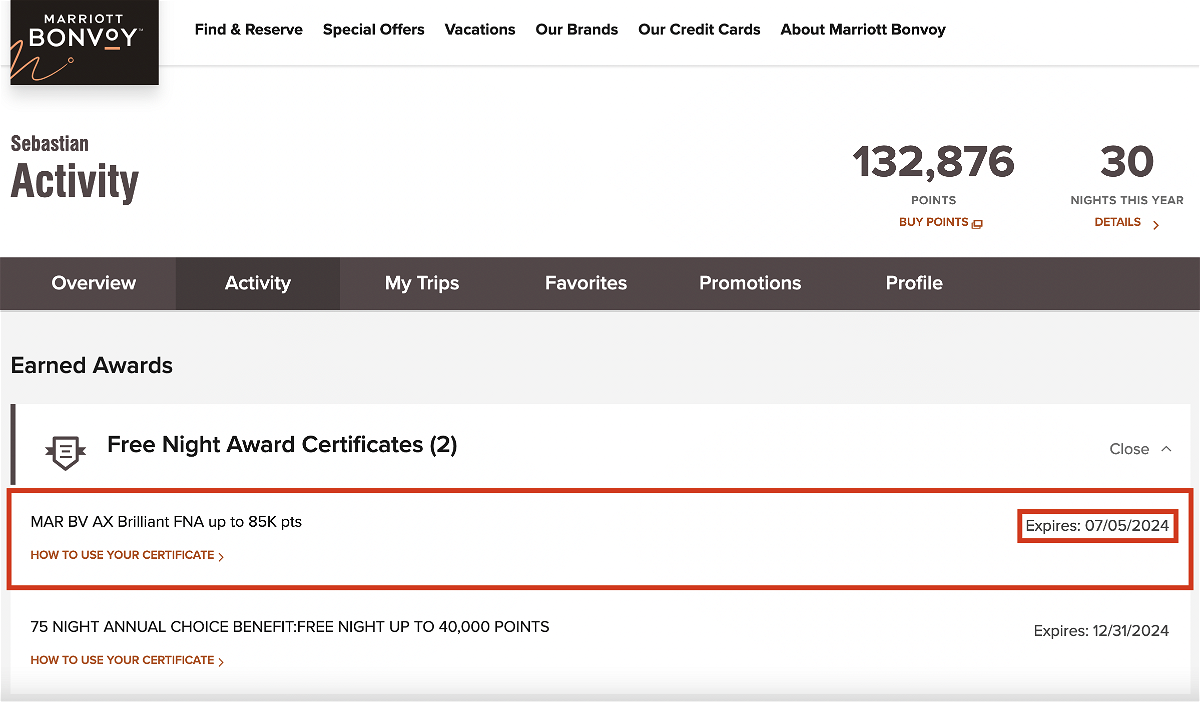

For anyone else, remember that you can also pay up to 15,000 points per certificate redemption on top so this will render it a bit more flexible as you can book something up to 100,000 points.

In most instances (not all), this covers very good properties, including a good range of Luxury Collection and Ritz Carlton properties. You will find, however, that these aspirational properties often exceed 100k as well, especially during peak dates. This leaves many members – myself included – frustrated as they can’t utilize their certificates.

Also, be aware that it expires a year after being deposited:

The expiration isn’t much of a problem for me but I can only recommend not to wait until the very last moment to find maximum value just to be pushed into a corner due to lack of availability, lack of upcoming travel, or high prices and then you end up being forced burning it at some dumpster property.

I know plenty of people who repeatedly got themselves into such a situation both with Hyatt and Marriott – don’t be that person!

My very own certificate I could have used last week in Tokyo at the Ritz Carlton and the value (compared to cash prices) would have been phenomenal but I’m not a fan of such older properties and will hold out for something better, maybe the St. Regis Hong Kong.

As far as our reader Michelle is concerned, I highly recommend her to take a trip somewhere where it makes sense to spend the night time- and money-wise. It doesn’t make sense to incur huge costs just to burn a free night at a nice hotel, so you should outweigh the benefits and opportunity costs.

Conclusion

A reader asked how to best utilize her Marriott Bonvoy Credit Card certificate, and there were a couple of issues with her situation. She might be better off changing the credit card if the certificate type gives her trouble.

Customers and members of these loyalty programs should continuously evaluate if certain memberships and products still make sense and then act accordingly. Try to find a reasonable use for your certificates, and that doesn’t always mean to squeeze every last cent of value out of them. It has to make sense for you!